straight life policy formula

Ad Straight life insurance. Ad Find the Right Life Insurance Policy for Your Needs.

What Is Cash Value Life Insurance Smartasset Com

A life insurance policys cash value is.

. On the death of the retiree the monthly payments. Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the life of the policy. Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the.

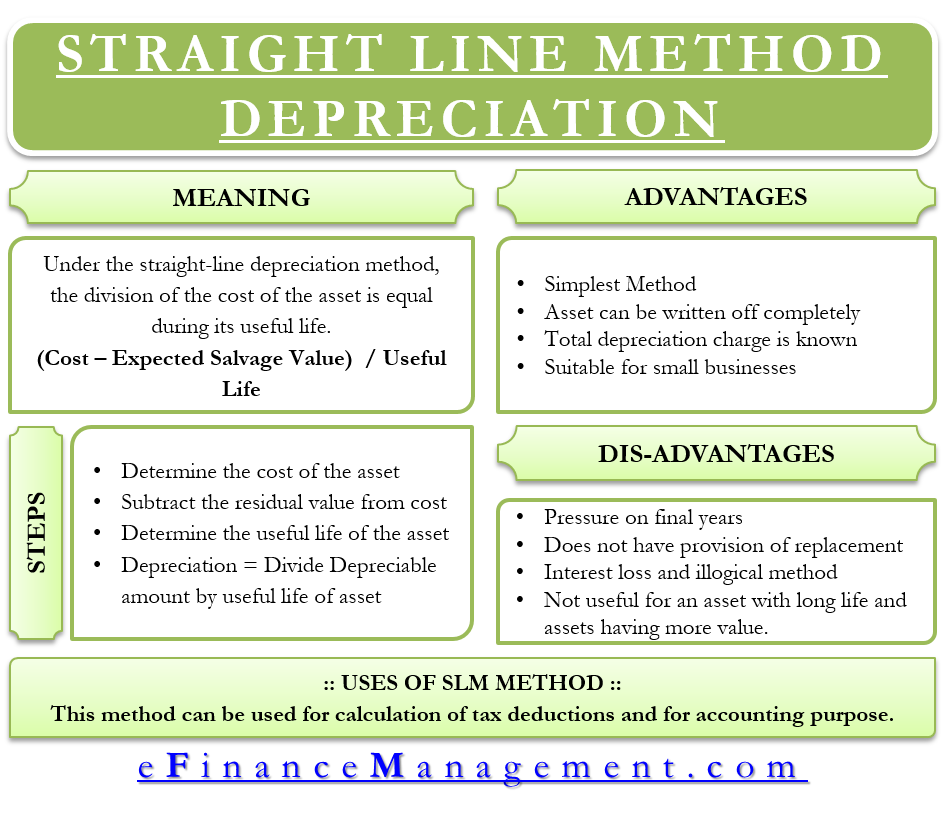

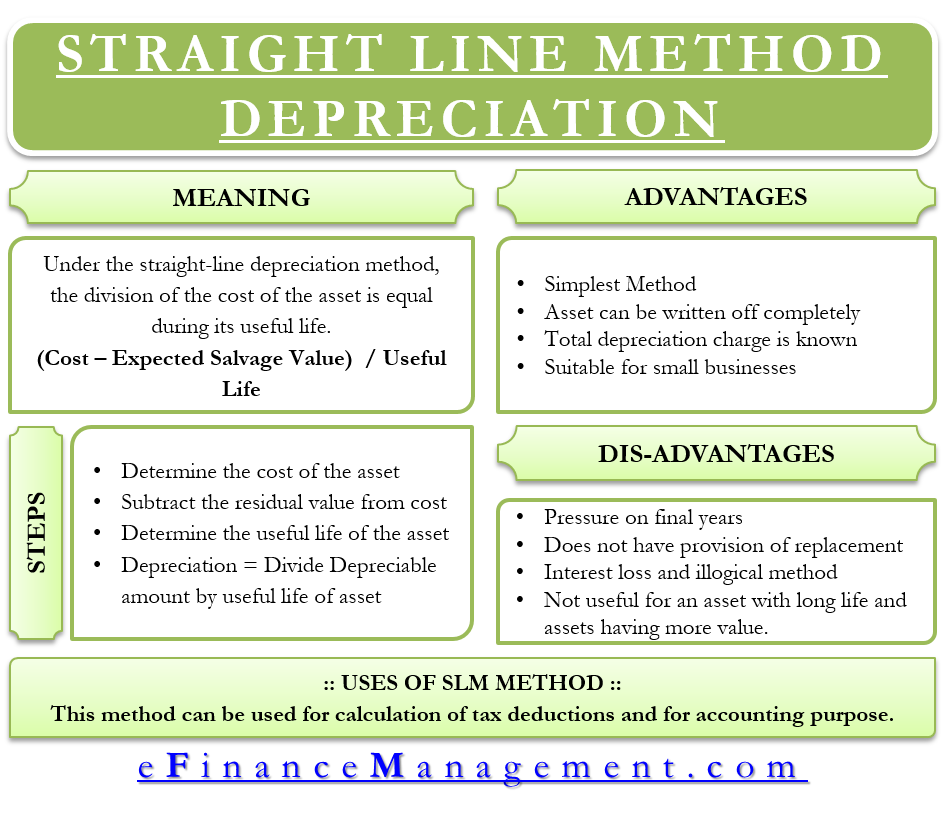

Straight life is the simplest benefit option offered by APERS. The depreciation rate is the annual depreciation amount total depreciable cost. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy.

If youre a psychologist you need liability insurance to protect yourself - Get a quote. Depreciation is calculated based on the fiscal years remaining. It is calculated based on the fiscal years remaining.

The DDB rate of depreciation is twice the straight-line method. The straight-line depreciation method spreads the cost evenly over the life of an asset. Does a straight life annuity policy make sense.

Straight Life Annuity. Also known as whole or ordinary life. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases.

A straight life insurance policy can also build cash. A straight life insurance policy often known as whole life insurance has a cash value account. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used.

Check Out the Latest Info. For example lets say a company. You then find the year-one.

Example of Straight Line Depreciation Method. Straight Life Annuity. The goal of a permanent policy is to have life insurance in place for the rest of your life.

In year one you multiply the cost or beginning book value by 50. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. Reviews Trusted by 45000000.

The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets useful life. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums. Ad Compare 2022s Best Life Insurance Providers.

The salvage value of asset 1 is 5000 and of asset 2 is 10000. Suppose we are given the following data and we need to calculate the depreciation using the straight-line method. This is expected to have 5 useful life years.

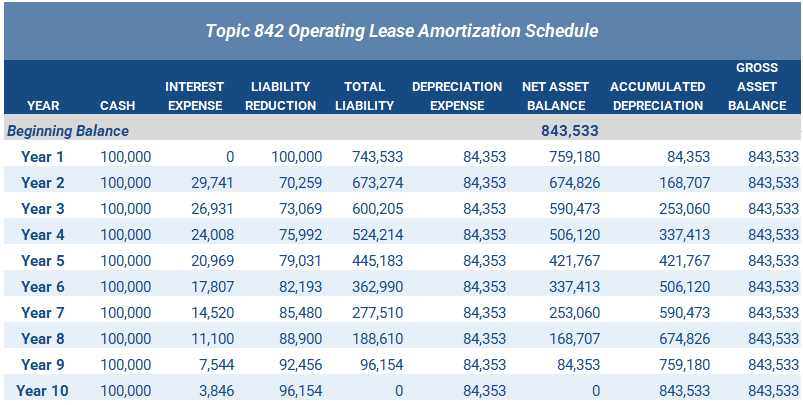

An insurance product that makes periodic payments to the annuitant until his or her death at which point the payments stop completely. If you select Fiscal in the Depreciation year field the straight line service life depreciation is used. In this case the machine has a straight-line depreciation rate of 16000 80000 20.

Each year you expense the same percentage. Ad We keep psychologists covered with customized insurance plans that fit your needs. Every calculation for other payment options.

Has purchased 2 assets costing 500000 and 700000. Divide the product by 12 to calculate your monthly straight life benefit. The straight life option pays a monthly annuity directly to the retiree for life.

Put You and Your Loved Ones on a Path Toward Financial Preparedness for the Future. Connect with a New York Life Agent. Calculate your annual straight life pension using your pension formula.

Cost of the asset. It is calculated based on the fiscal year which is defined by the fiscal. Browse Our Collection and Pick the Best Offers.

Example Straight-line depreciation.

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

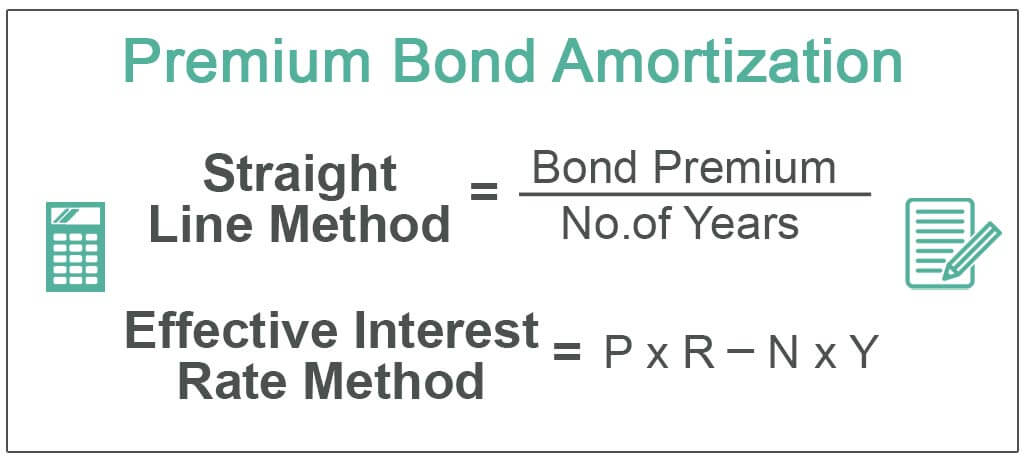

Amortization Of Bond Premium Step By Step Calculation With Examples

How Do You Calculate Life Insurance Cash Value

Limited Pay Life Insurance Everything You Need To Know

Cash Value Life Insurance Calculator Life Settlement Advisors

Period Certain Annuity What It Is Benefits And Drawbacks

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

Straight Talk 55 Gold Unlimited Talk Text Data 30 Day Prepaid Plan 15gb Hotspot Data Cloud Storage Int L Calling E Pin Top Up Email Delivery Walmart Com

Straight Line Depreciation Efinancemanagement

The Complete Resource For Straight Whole Life Insurance

Types Of Life Insurance Nerdwallet

How Much Life Insurance Do I Need Nerdwallet

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Accountingcoach

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-5eb88ace64ae40cfa39d93ba9a23f19c.png)

How To Calculate Insurance Premiums

How Much Life Insurance Do I Need Nerdwallet

Single Premium Life Insurance The Top 7 Pros Cons Of Spl

Straight Line Depreciation Method Explained W Full Example

Life Insurance Calculator How Much Do You Need Forbes Advisor